How to Trade Above Freeze Quantity in Options on Groww

To place an order above the freeze quantity in Options has just become simpler with Groww!

With our all-new order slicing feature, an F&O trader can easily place orders above the allowed limit, as Groww will automatically slice down your orders.

Traders wishing to acquire or sell huge quantities in Options without significantly changing the market price can make the most of this functionality.

How to Place Orders Above Freeze Quantity on Groww?

Let's say you are trading on expiry, and the price of the option contract you are interested in NIFTY 18000 Call, is Rs. 5.

You have Rs. 50000; in this case, you can take a position of 10000, but the allowed limit is 1800 by the exchange.

NOTE: Each underlying has its freezing limit, which the exchange sets. For example, 1800 for FINNIFTY and NIFTY, 900 for BANKNIFTY, 10000 for RELIANCE (stock option), and so on.

Now, you can easily do it on Groww.

We will slice your trade into a minimum number of orders.

Example, 10000 qty in NIFTY = (5 orders of 1800 quantity) + (1 order of 1000 quantity) [total of 6 orders]

Using this feature, you may buy big Options quantities to profit from even little movements, such as 0.5rs * 10000 Qty = Rs 5000 profit.

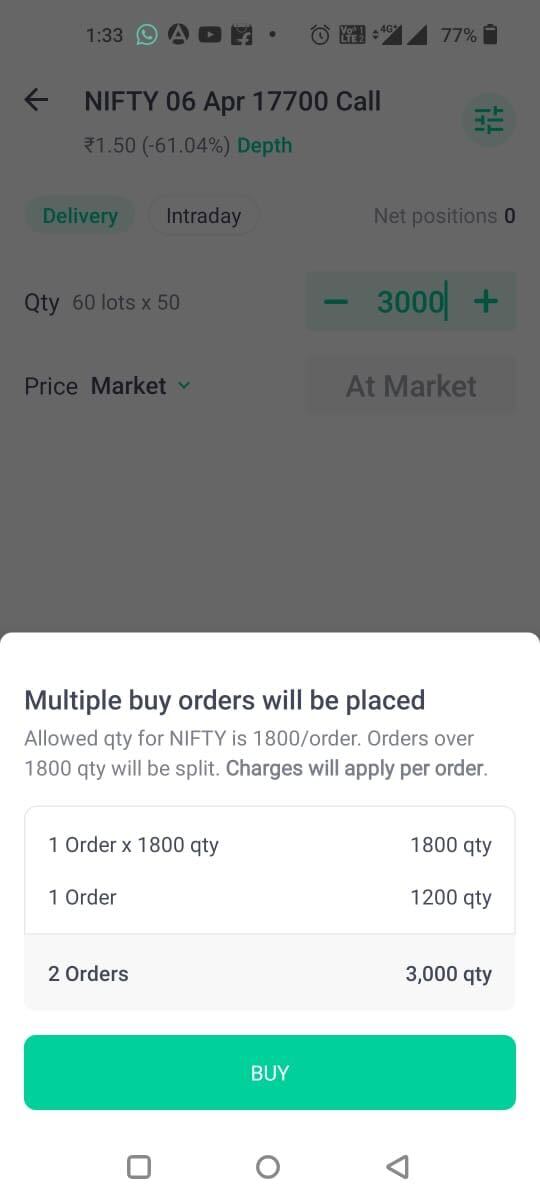

Furthermore, Groww will automatically divide your transaction into the smallest number of orders so that the brokerage is kept to a minimum. However, remember that brokerage fees will be assessed for each order. For example, if we divide your transaction into six orders, the brokerage fee will be 6 x 20 Rs.

For your better understanding, here are the steps to slice your order. This will help you trade above freeze quantity in Options on Groww-

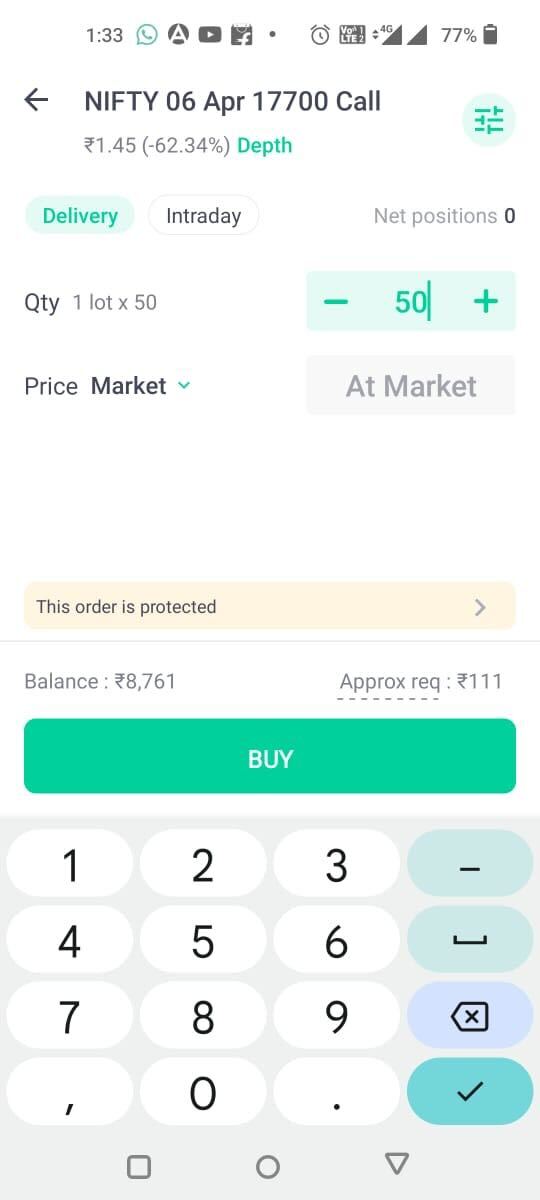

Step 1: Log in to your Groww account and choose the Options you wish to trade.

Step 2: To start a trade, click the 'Buy' or 'Sell' button.

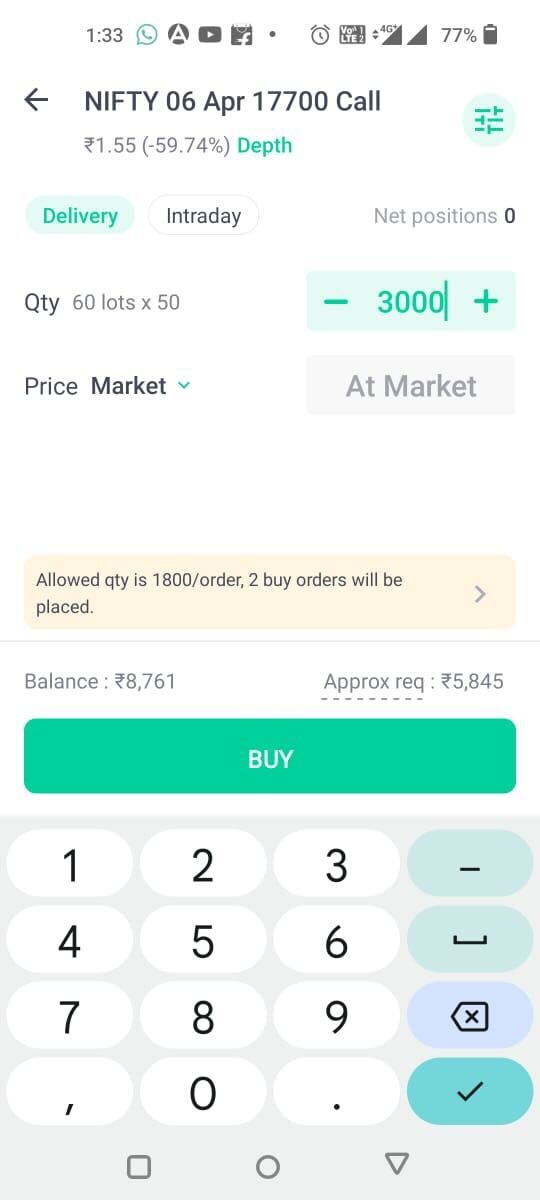

Step 3: Enter the total amount you wish to trade in the ‘Qty’ tab.

Step 4: Enter your desired price in the ‘Price’ tab.

Step 5: Here, Groww will automatically split your transaction into the smallest possible orders. For example, here user wanted to buy 3000 quantity, and we had split the trade into just 2 orders, one order of 1800 and 1 order of 1200 quantity.

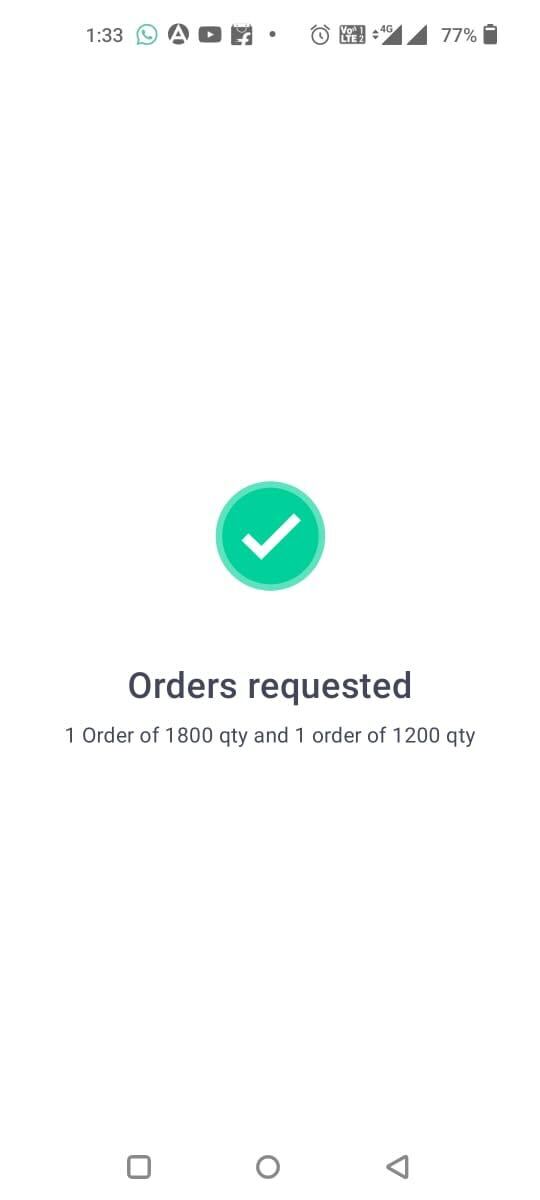

Step 6: A screen with the words 'Order Requested’ will appear, indicating that your order has been placed and the exact number of orders and quantity of orders placed for the same.

Similarly, by using this feature, you may simply Exit a large position, wherein we will break your exit order for the position into a minimum number of orders so that you can exit in a single click.

To do so, you may follow the steps below-

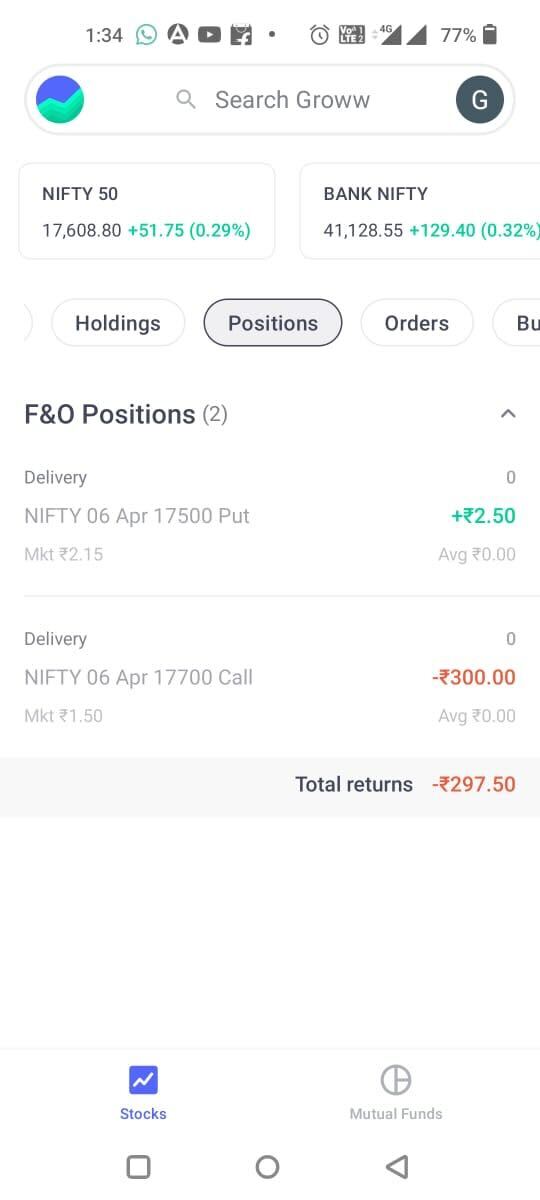

Step 1: Log in to your Groww account through Groww’s app or website.

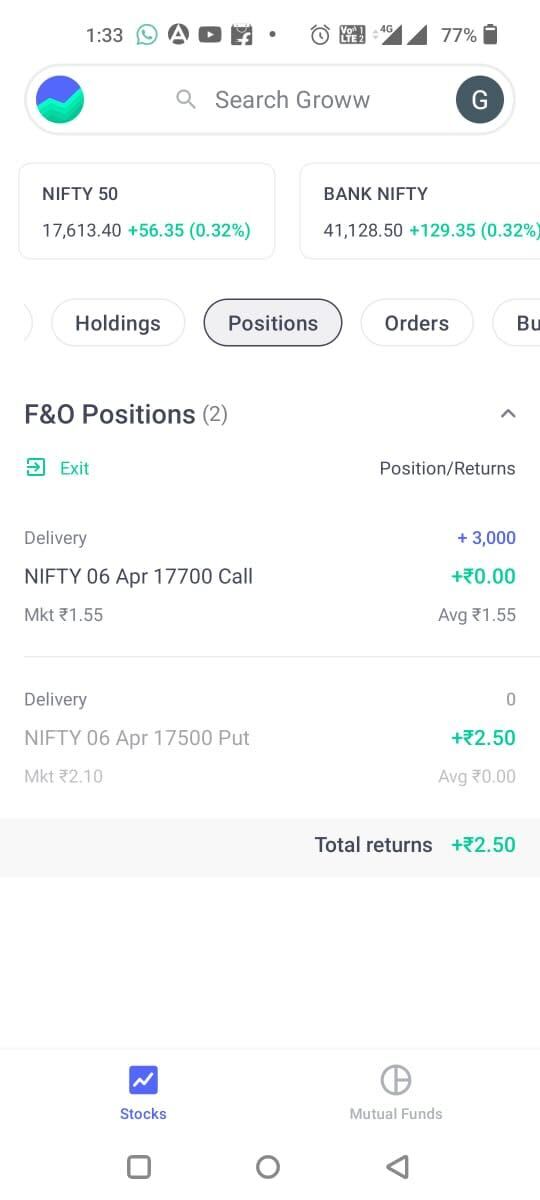

Step 2: In the F&O Positions tab, click the ‘Exit’ button.

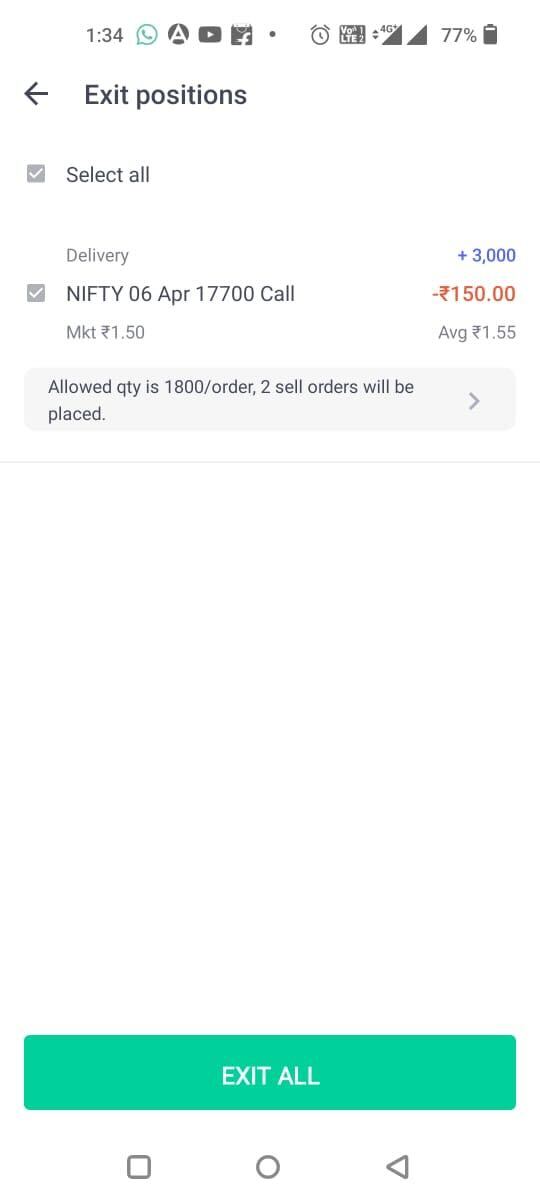

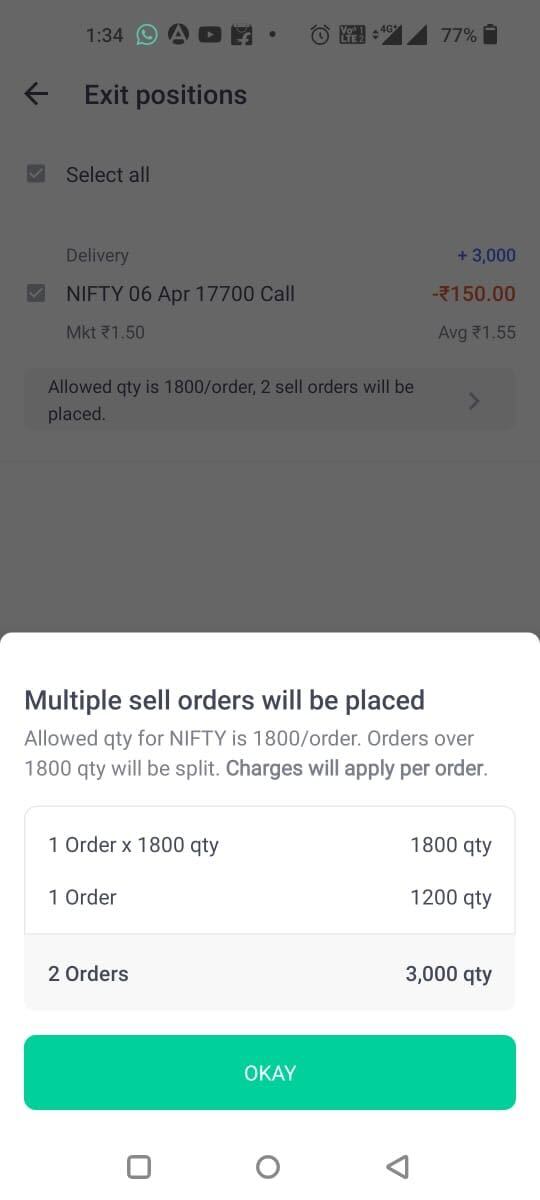

Step 3: Next, select the trade that you wish to exit. For example, a user wants to exit 3000 position, we had split the trade into 2 orders, i.e. 1 order of 1800 and 1 order of 1200 quantity. Now, the user can select the order from these that he desires to exit.

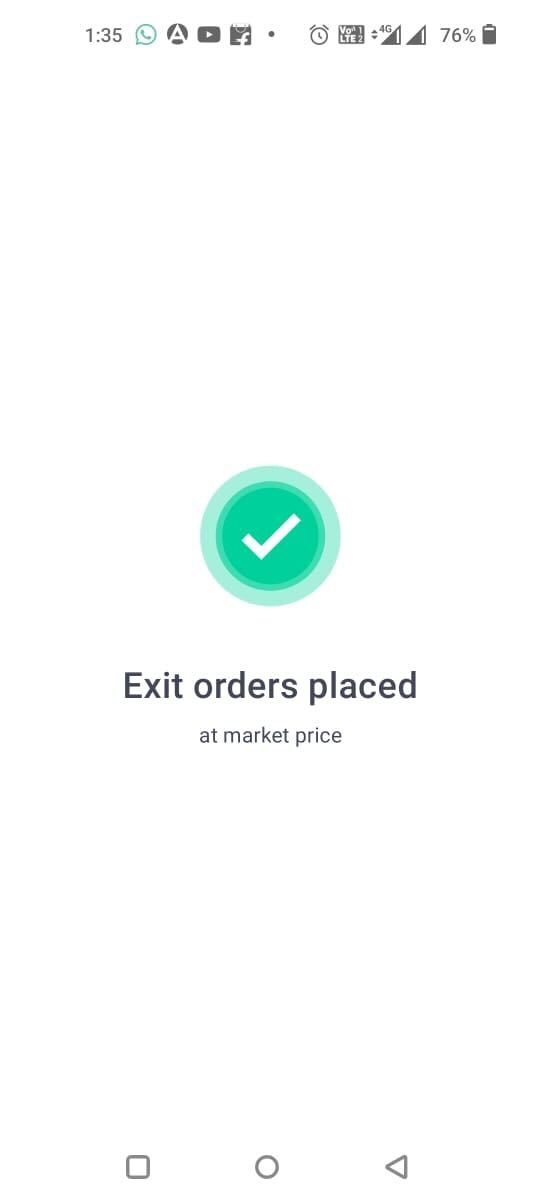

Step 4: The option 'Exit All' will appear on the next screen. Simply select that option by clicking on it.

Step 5: When you do this, you will see a screen that says 'Exit Orders Placed' implying that your Exit order has been placed and will be completed shortly.

The position squared off will appear in the following manner-

Companies | Type | Bidding Dates | |

| SME | Closes Today | ||

| SME | Closes 15 May | ||

| SME | Closes 15 May | ||

| SME | Closes 15 May | ||

| SME | Closes 16 May |

Conclusion

Order Slicing, which allows trading in large quantities, can assist investors in avoiding market impact and price slippage that can occur when huge trades are made.

This functionality to trade above the freeze quantity in Options has been introduced by Groww to simplify your trading experience.

With this feature, we execute orders in smaller chunks based on pre-defined factors such as the display quantity and the maximum order size. This allows you to have the least market influence while accomplishing the necessary transaction execution.