How to Read Candlestick Charts for Intraday Trading

Intraday trading is a method of investing in stocks where the trader buys and sells stocks on the same day without any open positions left by the end of the day.

Hence, intraday traders try to either purchase a share at a low price and sell it higher or short-sell a share at a high price and buy it lower within the same day. This requires a good understanding of the market and relevant information that can help them make the right decisions.

In the stock market, the price of a share is determined by its demand and supply, among other factors.

Tools such as candlestick chart patterns offer great help to traders. We will talk about these Candlestick Charts and offer steps to help you read them.

What are Candlestick Charts/Graphs?

Candlesticks are a visual representation of the size of price fluctuations. Traders use these charts to identify patterns and gauge the near-term direction of price.

Companies | Type | Bidding Dates | |

| SME | Closes 15 May | ||

| SME | Closes 15 May | ||

| SME | Closes 15 May | ||

| SME | Closes 16 May | ||

| Regular | Closes 17 May |

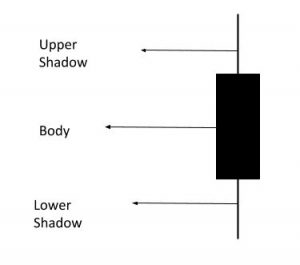

Composition of a Candlestick Chart

This is how a candlestick chart pattern looks like:

As you can see, there are several horizontal bars or candles that form this chart. Each candle has three parts:

- The Body

- Upper Shadow

- Lower Shadow

Also, the body is colored either Red or Green. Each candle is a representation of a time period and the data corresponds to the trades executed during that period.

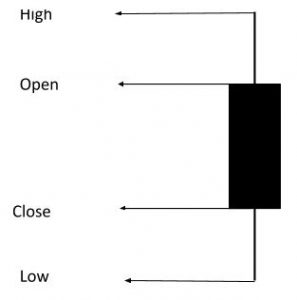

A candle has four points of data:

- Open – the first trade during the period specified by the candle

- High – the highest traded price

- Low – the lowest traded price

- Close – the last trade during the period specified by the candle

How to Analyse Candlestick Chart

The body of the candle represents the opening and closing price of the trading done during the period. Knowing this is important for candlestick trading. Hence, traders can see the price range of the said stock for the said period at a glance. Also, the color of the body can tell them if the stock price is rising or falling. So, if a candlestick chart for one month with each candle representing a day has more consecutive reds, then traders know that the price is falling.

Above and below the body are vertical lines called wicks or shadows that show the lows and highs of the traded price of the stock. Here is a scenario:

- If the upper wick on a red candle is short, then it indicates that the stock opened near the high of the day.

- On the other hand, if the upper wick on a green candle is short, then it indicates that the stock closed near the high of the day.

Hence, a candlestick graph displays the relationship between the high, low, opening, and closing price of a stock. The body can be long or short and red or green. Also, shadows can be long or short. A combination of these displays the sentiment of the market towards the said stock. These details are important to know to understand how to read a candle chart.

Candlestick Chart Patterns

Candle chart patterns are an excellent way of understanding investor sentiment and the relationship between demand and supply, bears and bulls, greed and fear, etc.

Traders must remember that while an individual candle provides sufficient information, patterns can be determined only by comparing one candle with its preceding and next candles. To benefit from them, it is important that traders understand patterns in candlestick charts.

For better understanding let’s divide the patterns into two sections:

- Bullish patterns

- Bearish patterns

Both patterns are essential for candlestick chart analysis.

Bullish Patterns

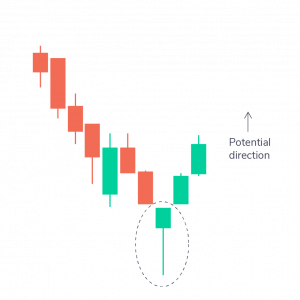

- Hammer Pattern

This is a candle with a short body and a long lower wick. It is usually located at the bottom of a downward trend. It indicates that despite selling pressures, a strong buying surge pushed the prices up. If the body is green, it indicates a stronger bull market than a red body.

- Inverse Hammer Pattern

This is a candle with a short body and a long upper wick. It is usually located at the bottom of a downward trend too. It indicates buying pressure followed by selling pressure. It also indicates that buyers will soon have control.

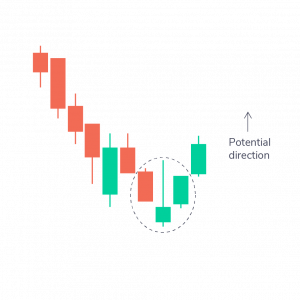

- Bullish Engulfing Pattern

This is a pattern of two candlesticks where the first candle is a short red one engulfed by a large green candle. It indicates a bullish market that pushes the price up despite opening lower than the previous day.

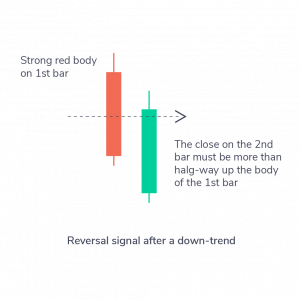

- Piercing Line Pattern

This is a two-candle pattern having a long red candle followed by a long green candle. Also, the closing price of the second candle must be more than half-way up the body of the first candle. This indicates strong buying pressure.

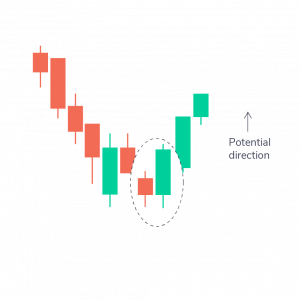

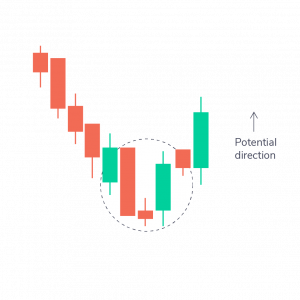

- Morning Star Pattern

This is a three-candle pattern that has one candle with a short body between one long red and a long green candle. There is usually no overlap between the short and the long candles. This is an indication of the reduction of the selling pressure and the onset of a bull market

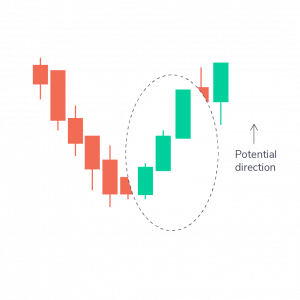

- Three White Soldiers Pattern

This is a three-candle pattern that has three green candles with small wicks. These candles open and close higher than the previous day. After a downtrend, this is a strong indication of an upcoming bull trend.

Bearish Patterns

- Hanging Man Pattern

This is a candle with a short body and a long lower wick. It is usually located at the top of an upward trend. It indicates that the selling pressures were stronger than the buying thrust. It also indicates that bears are gaining control of the market.

- Shooting Star Pattern

This is a candle with a short body and a long upper wick. It is usually located at the top of an upward trend too. Usually, the market opens higher than the previous day and rallies a bit before crashing like a shooting star. It indicates selling pressure taking over the market.

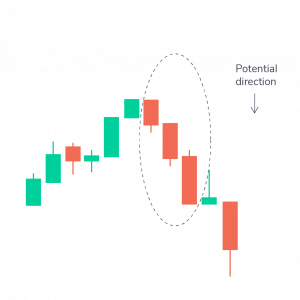

- Bearish Engulfing Pattern

In candlestick chart analysis, this is a pattern of two candlesticks where the first candle is a short green one engulfed by a large red candle. It usually occurs at the top of an upward trend. It indicates a slowdown in the market rise and an upcoming downtrend. If the red candle is lower, the downtrend is usually more significant.

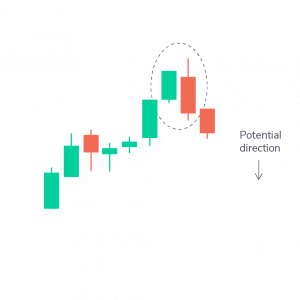

- Evening Star Pattern

This is a three-candle pattern that has one candle with a short body between one long red and a long green candle. There is usually no overlap between the short and the long candles. This is an indication of the reversal of an upward trend. This is more significant if the third candle overcomes the gains of the first candle.

- Three Black Crows Pattern

This is a three-candle pattern that has three consecutive red candles with short wicks. These candles open and close lower than the previous day. After an upward trend, this is a strong indication of an upcoming bear market.

Chart patterns are an important component of how to read a candle chart. There are several other patterns that can be followed to understand trends and sentiment of the markets. You can consider this blog as a starting point to understand how to analyse candlestick chart and dive deeper into these patterns to understand market movements.

Happy Investing!

|

You may also want to know |

|

|

1. |

|

|

2. |

|

|

3. |

|

|

4. |

|

|

5. |

How to Invest in Stock Market With Little Money? |